Streamline your property due diligence process by producing reports that are in line with brand standards, free of errors and easily…

Learn moreCollateral360®

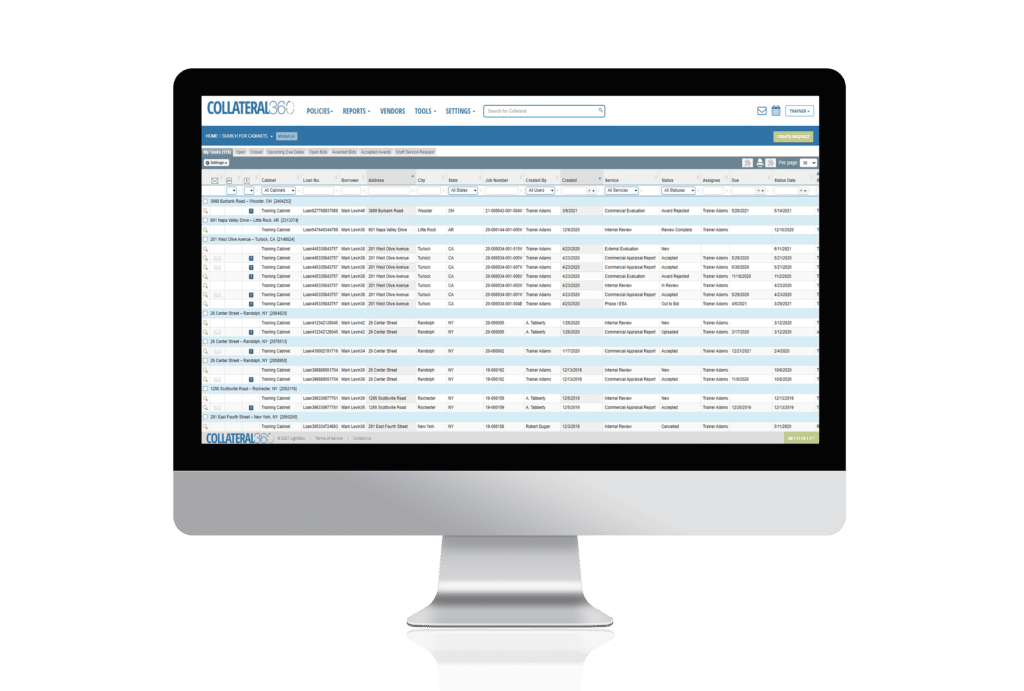

Manage all your property due diligence and compliance from a single dashboard

From appraisal procurement and environmental reports to flood certificates, and more, Collateral360 is a web-based application helping lenders better manage critical processes, risk, and compliance. As a compliance tool, Collateral360 allows lenders to build their policy into their workflow, ensuring each loan is managed to credit and risk policy.

Request A Demo LoginStreamline your workflow

Significantly improve your loan management workflow by performing every task from a single dashboard:

- Streamlined invoice management

- Customizable online review memo

- Trigger on status, automation of services

- Task management-routing rule automation

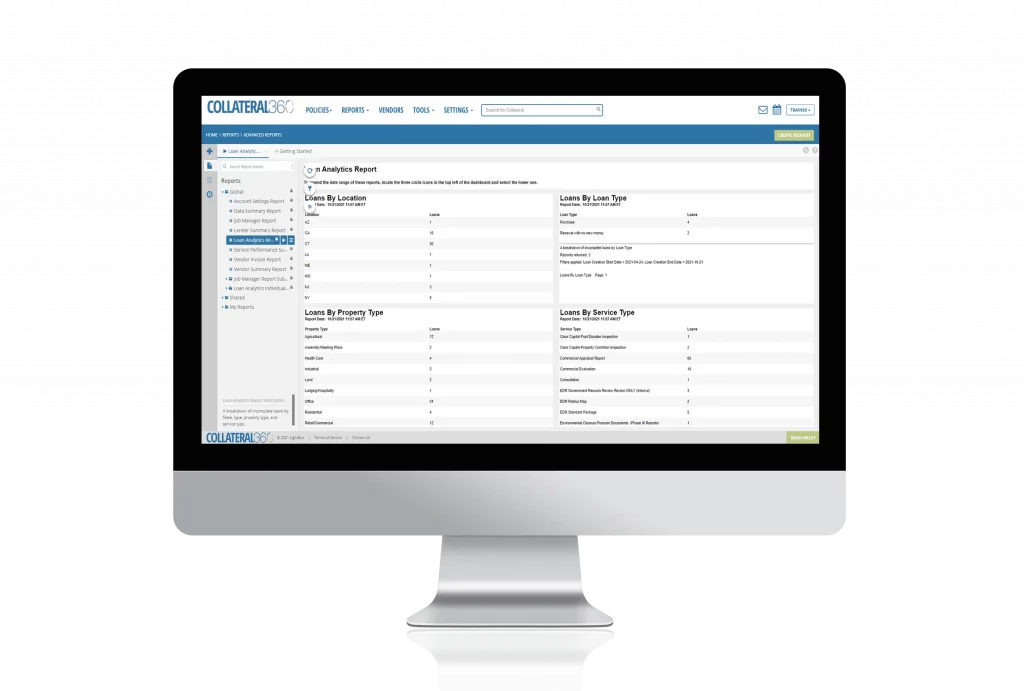

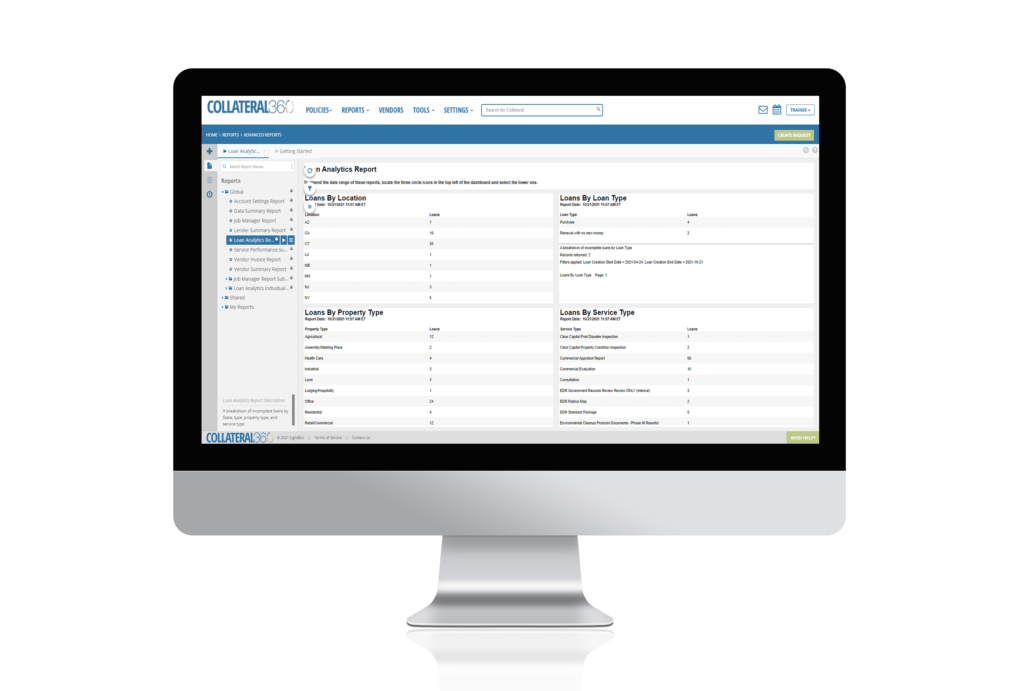

Compliance management

Easily manage compliance and regulatory risk, including:

- Comprehensive vendor management

- Robust reporting capabilities

- Documented appraisal delivery and amendments

- Track communication with all parties associated with the loan file

- Easily meet FIRREA and other requirements

Integrated Third-Party reports

Comprehensive built-in vendor marketplace. Order all data services needed to manage your due diligence and procurement, such as:

- Appraisal and Environmental Reports

- Site inspections

- Exterior/interior inspections

- Evaluations

- Flood certificates

Trusted, comprehensive environmental data

Easily screen properties for environmental issues:

- Instantly identify any environmental concerns and plot their location in relation to the property using our environmental database–the largest in the nation.

- Identify risk as being low or elevated using our algorithm-based opinion generator.

Simplify lending operations. Improve risk management. Manage regulatory demands.

Accelerate loan approvals

Reduce loan origination time by streamlining tasks across your entire enterprise, all managed in one secure SaaS environment.

Control lending risk

Incorporate lending policies into your workflow, ensuring each transaction is managed to credit, risk and regulatory standards.

Comply with excellence

Manage ever-changing workstreams, projects and portfolios, all while providing a wide range of capabilities.

Oversee vendor management

Oversight of an approved catalog of preferred partners that allows for a simplified ordering process of additional services.

Recommended Insights

Using Technology to Unlock Data in Commercial Real Estate Appraisals

LightBox CRE Monthly Commentary: CRE Pros Try to Answer the $64,000 Question – When Will CRE Relaunch?

Q1 Preliminary Results Show Signs of Gradual Thaw

Have questions? Want a demo? Let’s chat.

Fill out the form below and a member of our Sales Team will contact you shortly.