Subscribe to LightBox Insights

Gain market-moving insights from industry experts.

We will not share your data. View our Privacy Policy.

blog

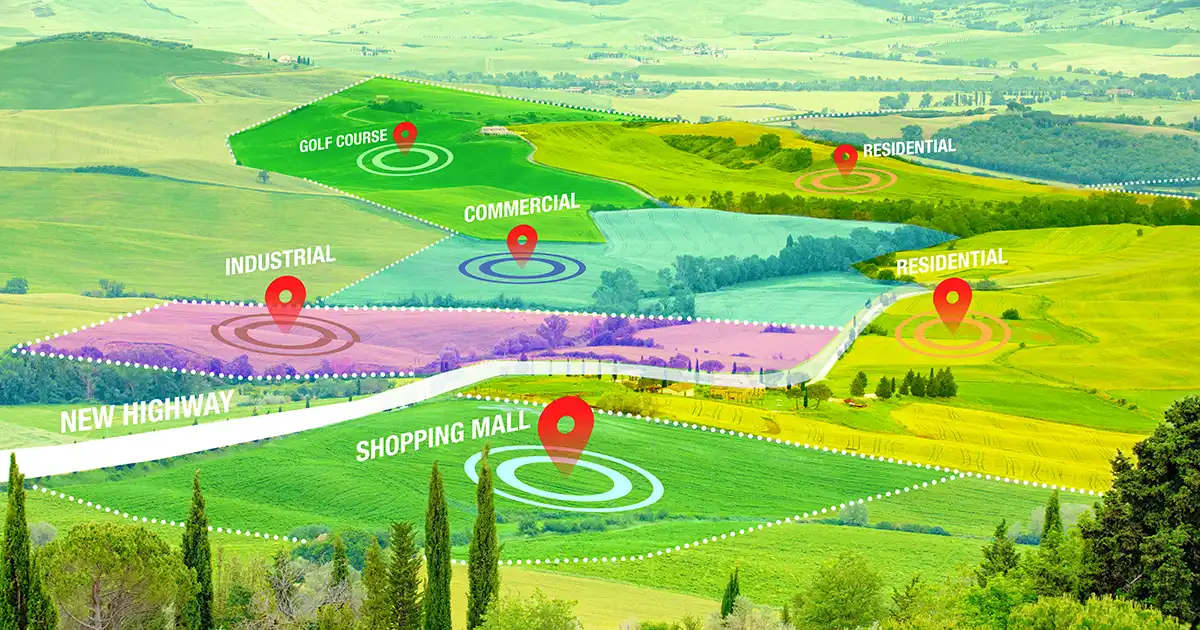

How CRE Brokers Leverage LandVision for Targeted Site Selection

April 25, 2024

< 1 min

Subscribe to LightBox Insights

Gain market-moving insights from industry experts.

We will not share your data. View our Privacy Policy.

View