Get digitally reproduced photos from each decade, often beginning in the 1930’s and continuing to present day….

Learn moreEDR®

The industry’s most trusted data source for more than 30 years

LightBox Environmental Data Resources delivers the highest quality data in the industry, in the fastest turnaround, along with innovative workflow tools for quality, collaboration, and efficiency. With over 2,000 databases, and the nation’s largest collection of historical resources, LightBox EDR puts the power of quality data and insight into the hands of the industry’s most successful site assessors.

Request A Demo Login

Key Benefits

Your one-stop shop for due diligence data

Order the industry’s leading government records report and a full suite of historical resources, all in one place.

Customer service you expect & trust

Tens of thousands of environmental professionals have trusted LightBox EDR since 1990 for their due diligence needs. You have a team of dedicated account representatives assigned specifically to your business, aligned to your success.

Deliver your reports faster

The market has never been more competitive, and turnaround time is critical. Your data comes fast and integrated in a single viewer, and report writer, allowing you to deliver high quality reports, faster.

Meet the new ASTM E1527-21 Standard

We have enhanced our data, historical reports, and report writing platform to make it easier for you and your staff to meet the new ASTM standard. Keep your staff up to date on industry adoption by visiting our ASTM Resource Center.

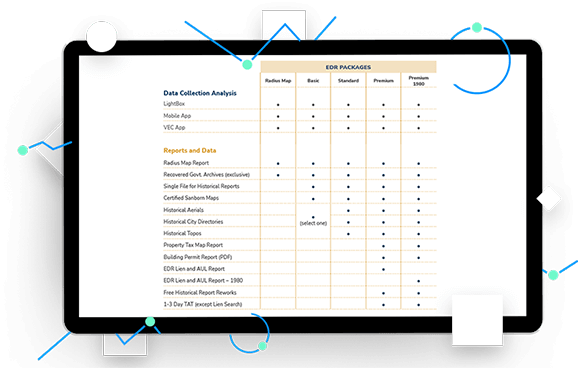

We’ve got you covered

LightBox EDR packages are created to make accessing comprehensive Environmental Due Diligence information fast, easy, & cost effective

LightBox EDR packages include the industry’s best data, content and workflow technology to help you perform property due diligence with efficiency and ease.

With your LightBox EDR Basic, Standard and Premium Packages, you will receive the most trusted government records and historical sources, along with cutting-edge workflow tools.

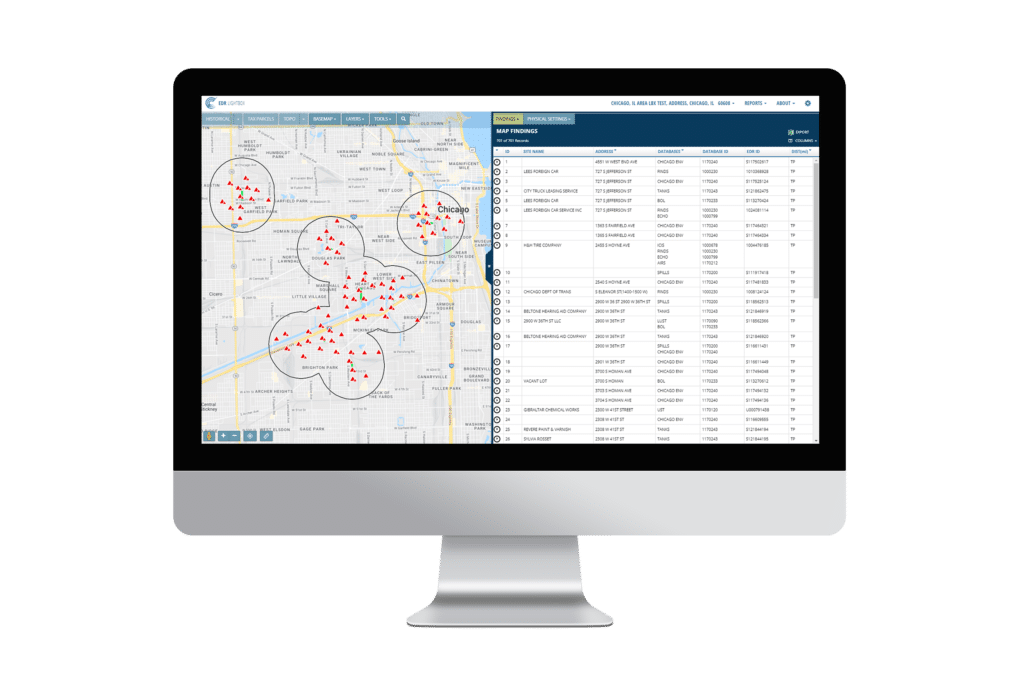

EDR® Radius Map Report with GEOCHECK®

The industry standard for Phase I’s for two decades

The EDR® Radius Map with GEOCHECK® is the leading government records report in the industry.

Rigorously updated and curated, this report searches over 2,000 databases and layers, from federal, state, tribal, local, and proprietary sources.

It is delivered quickly, in either PDF format or through the LightBox data viewer.

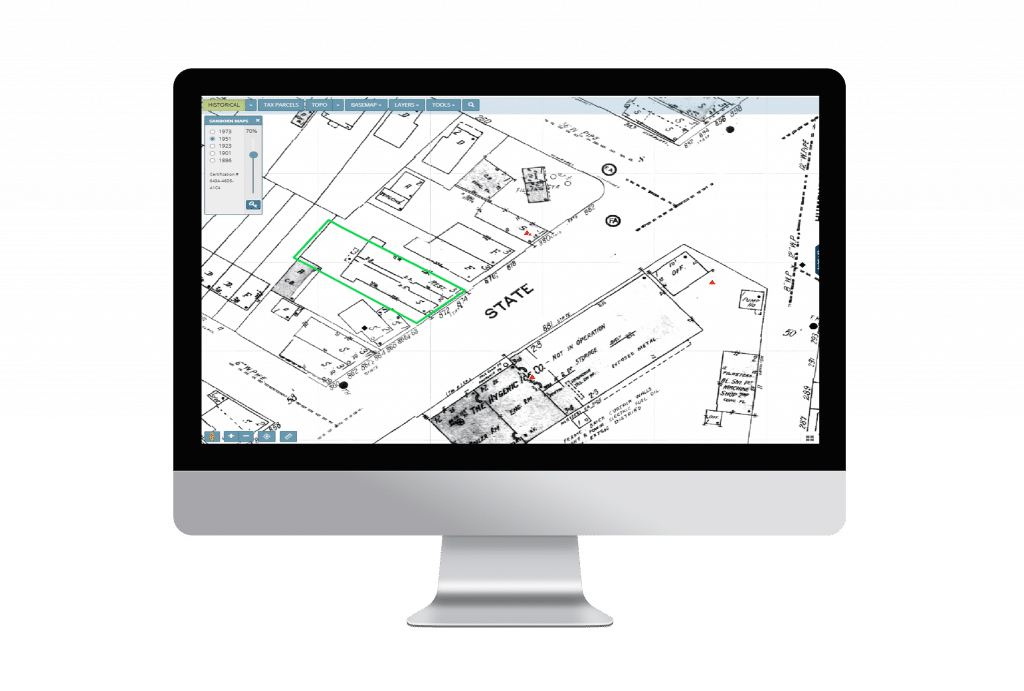

SANBORN MAP® Report

Access the largest collection of SANBORN® Fire Insurance Maps available in the market

The Certified SANBORNMAP® Report is the result of a search of the complete holdings of the SANBORN® Library, which dates from 1866 and includes over 1.3 million SANBORN® Fire Insurance Maps.

This essential Phase I ESA historical information source tracks the changing landscape and property uses of approximately 12,000 American cities and towns since the late 19th century.

EDR® City Directory Reports

LightBox EDR brings together multiple sources, collections, & publishers in one simple to order service

What’s the best way to find City Directory information?

Search our City Directory Super Library, the largest collection of historical city directory information ever assembled.

Through exclusive agreements with major publishers, our own hard copy and digital collections, and our researchers at major libraries across the country, our City Directory reports provide you with unmatched national coverage and speed of access.

Historical Aerial Photographs

Access the largest collection of historical aerial photography in the country.

The Historical Aerial Decade Package meets and exceeds ASTM E1527-13 requirements.

Our historical aerial packages include digitally reproduced photos from each decade, typically beginning in the 1930s, ’40s or ’50s and continuing through the 1990s or 2000s.

Historical aerial photos from EDR LIGHTBOX® have been geo-referenced to make locating your target property easier than ever.

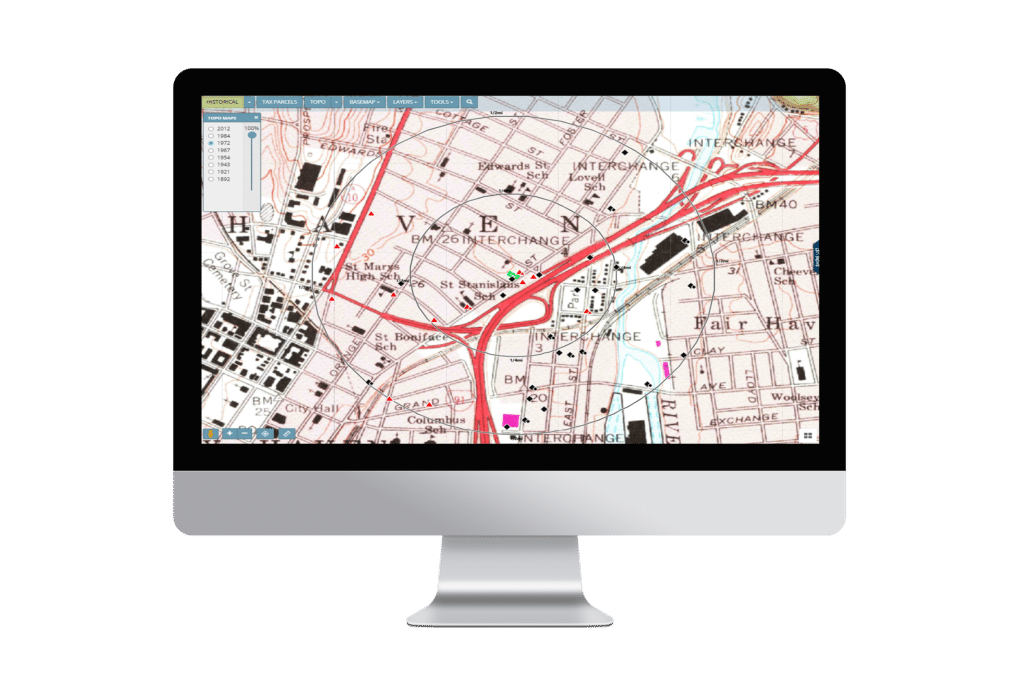

Historical Topographic Maps

Historical topographic maps with QUADMATCH® aid environmental professionals in evaluating potential liability resulting from past activities.

We recently launched QUADMATCH®, an advanced mapping solution that intelligently presents USGS historical topographic quad maps, making review faster and easier.

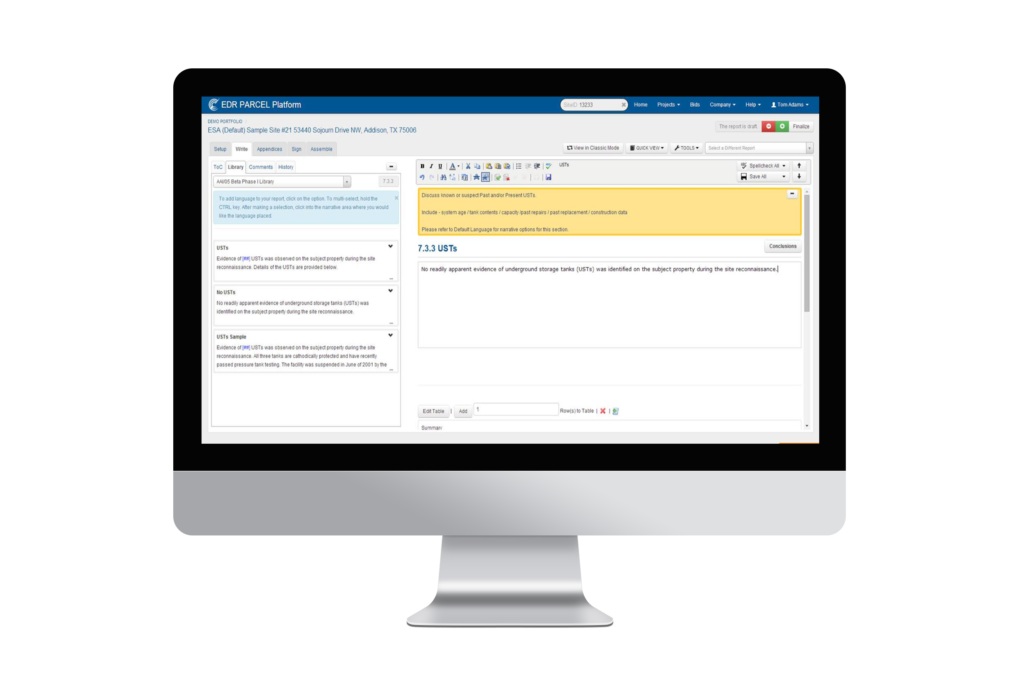

PARCEL Report Writer

Create more consistent, accurate Environmental Reports in 40% less time

Want to do your best work faster? We’ve got you covered with PARCEL Report Writer.

PARCEL is a collaborative platform that gives you the control you need to produce higher quality reports in far less time with a lot less hassle. Property assessors that write reports using Microsoft® Word® struggle with templates, formatting, importing data and images, version control and consistency.

PARCEL Report Writer makes it easy to do all of that.

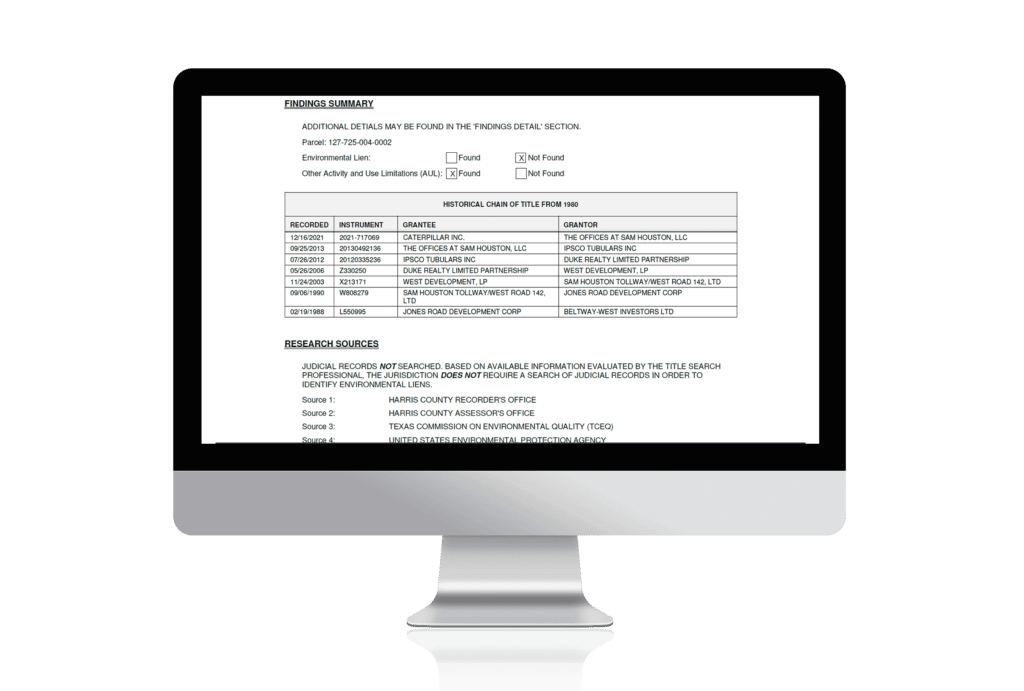

EDR®Environmental Lien & AUL Search Reports

Our reports provide a search of official land title records for environmental liens and activity use limitations.

- EDR Environmental Lien and AUL Search

- EDR Environmental Lien and AUL 1980 Search

Environmental Lien & AUL Search Reports can be purchased through EDR as a stand-alone report, and are also included in select packages.

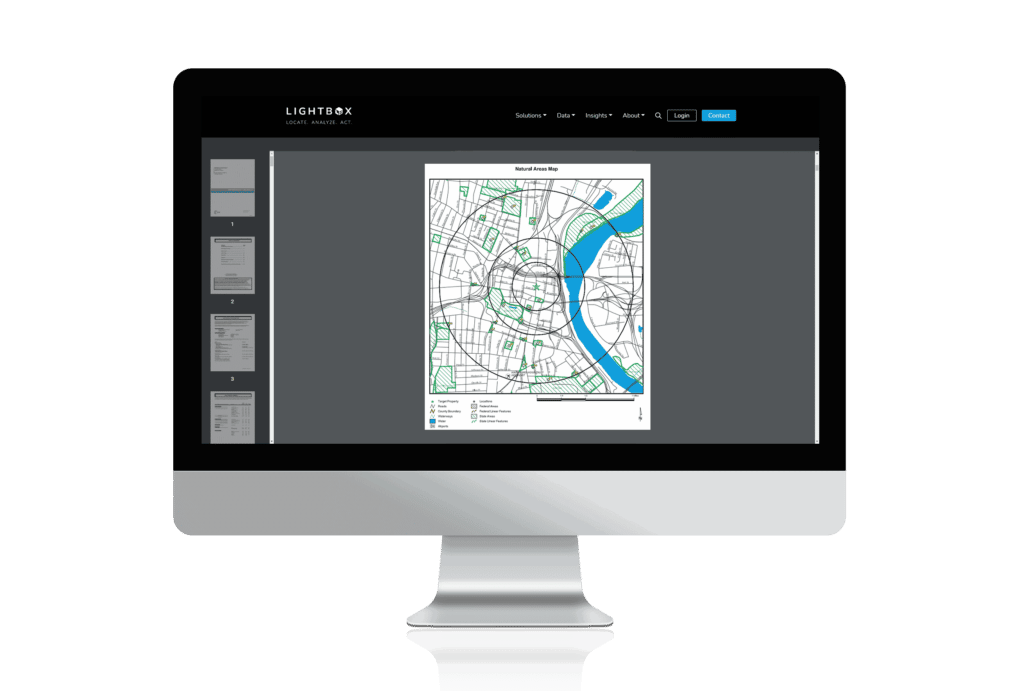

NEPASearch Map Report

The EDR® NEPASearch Map Report provides the most comprehensive set of NEPA information available.

NEPA requires that federal agencies analyze potential environmental effects of proposed actions and their alternatives, avoid or minimize adverse effects of proposed actions, and restore and enhance environmental quality.

A valuable resource for the preparation of environmental impact assessments and related studies.

Connected Data

Parcel Boundaries

Nationwide parcel boundaries with 300+ property and tax attributes to help you make more confident decisions. Covers 3,100+ U.S. counties including territories, with over 150 million parcels with polygon geometry that is completely normalized.

Flood Risks

Data includes, but is not limited to, 100-year and 500-year flood zones. Canadian Flood maps provide flood extents and depths for multiple return periods, covering river, surface and coastal flooding.

Building Footprints

Building footprints are geospatial boundaries that provide the outline of a building drawn along the exterior walls.

Recommended Insights

USEPA Issues Expected Rule Designating PFAS as CERCLA Hazardous Substance

The Changing Landscape of Data Center Zoning

LightBox helps California Forever accomplish analysis for large-scale planning project with diverse datasets

Have questions? Want a demo? Let’s chat.

Fill out the form below and a member of our Sales Team will contact you shortly.