Answers on How To Address PFAS Risk as Regulations Take Shape

Emerging information on the dangers of Polyfluoroalkyl Substances, or PFAS, is creating confusion and concern across the environmental industry. Many states have put new guidelines and regulations in place for managing PFAS risks, and the U.S. EPA will likely act soon. In today’s uncertain regulatory environment, what do environmental due diligence professionals need to be aware of to prevent liability for themselves and their clients? What does PFAS mean on M&A deals? How much does sampling cost? When will EPA recognize PFAS as a hazardous substance under CERCLA? These are some of the questions our panelists addressed during October Due Diligence at Dawn workshops.

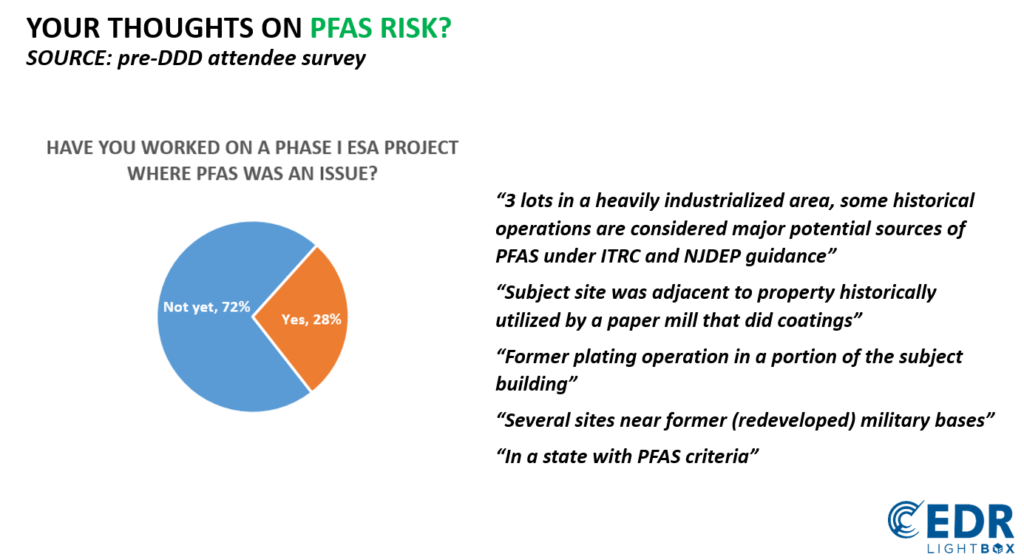

Current Practice on PFAS

Based on the results of a survey we conducted prior to our DDDs, roughly three in ten environmental professionals have already worked on a Phase I ESA where PFAS was an issue. In many cases, it was due to a nearby property involved in former operations where PFAS was used. Phase I ESAs in states that are proactively regulating PFAS exposure are also driving attention. Among the greatest areas of confusion surrounding PFAS risk are: differences in state standards, the lack of cleanup criteria, unknowns regarding screening levels and, amid the uncertainty, how consultants should be explaining to clients what PFAS is and whether to address it during a Phase I ESA.

Q&A With Leading Experts

At our October DDD in Arlington, VA, there was a track titled “Practical Information for Managing PFAS Risk” featuring a panel of leading experts who shared their thoughts on the confusion surrounding PFAS risk—and what it means in today’s commercial real estate deals. Below are answers from our three experts on some of the most common technical, legal and practical questions surrounding PFAS in this uncertain time.

Geoff Pellechia, SGS North America EHS

What types of current or former operations identified during due diligence should raise red flags for PFAS risk?

Pellechia: PFAS have been used in various industries, including metal plating, plastics manufacturing, semiconductor and photo imaging, wire manufacturing, textile and leather and paper products,consumer products, among others. Its use is most often referenced with respect to the use of aqueous film-forming foams developed by the U.S. Navy in the 1960s and used as a fire-fighting foam. As such, sites that used or stored AFFF, including military installations (e.g., former DoD sites), commercial airports, fire training areas and local fire departments present a high potential for PFAS risk. As dry cleaning sites are starting to be tested, many are showing significant PFAS levels. In addition to these sites, there have been widespread issues with wastewater treatment plants, biosolids and landfills. There should also be special attention paid to sites located in areas with PFAS regional issues. Merrimack, NH, for example, has been in the news due to years of plant emissions from a performance plastics manufacturer, and the Cape Fear River area in North Carolina has made headlines related to Gen-X contamination from a Chemours facility.

Why should we concerned about PFAS during due diligence?

Pellechia: This family of chemicals is unique in that they create health risks in very small amounts. Limits are expressed in terms of parts per trillion, or ppt, instead of parts per billion (ppb) or parts per million (ppm) like most contaminants. For perspective, looking to detect 2 ppt is the equivalent of looking for one drop in 20 Olympic-size swimming pools. Also of concern is the fact that PFAS have been omitted from prior due diligence and site investigations, and there are already insurance exclusions from coverage. Because of all the news and pressure from the public, there is rapidly increasing litigation. This forces the question: “Whose PFAS is it?”, which creates an environment of finger pointing. Lastly, there are uncertainties in how to assess and manage risk, and PFAS contamination has added significant complexity and cost.

When does it make sense to sample? How much does it cost? What limits are you sampling against?

Pellechia: When it comes to commercial real estate transactions, it’s really been buyer beware. Sellers are resisting PFAS testing since there is no legal enforcement. It comes down to the state level. We have already been involved in some commercial real estate projects where the state added PFAS compounds to what a sellers need to disclose about a property.

“Sampling costs for PFAS will vary and is hard to quantify, but I would say it has probably doubled the cost of a typical Phase II ESA. Eventually, it may come to a point where financial institutions are the ones requiring PFAS testing before originating a commercial property loan.”

~Geoff Pellechia, SGS

What’s next for PFAS?

Pellechia: Federal and state regulations to address PFAS risk are being developed and/or updated frequently. One area to watch is whether PFOA and PFOS will be considered hazardous substances under CERCLA. Even without federal standards, however, litigation will continue. We can also expect to see future NPDES permits for PFAS-related compounds in wastewater discharge from wastewater treatment plants, storm water and various industrial operations; restrictions on waste impacted with PFAS to landfills and other waste storage facilities; PFAS air emission regulation and monitoring; formal EPA methods for PFAS analysis and groundwater standards for PFAS at the state level.

Amy L. Edwards, Attorney and Partner, Holland & Knight’s Public Policy and Regulation Group

You’re based in DC. What do you expect to see happening at the federal level on PFAS? When might we see PFAS recognized as a hazardous substance under federal CERCLA law?

Edwards: Neither Congress nor the U.S. EPA has yet designated PFAS (individually or as a class) as hazardous substances under CERCLA. Such a designation if/when it happens will trigger Superfund liability and cleanup requirements for PFAS at Superfund sites. It is worth noting that at least three states (NY, CO, NM) have designated some PFAS as hazardous substances or toxic substances. The EPA has also initiated the regulatory process for listing PFOA and PFOS as CERCLA hazardous substances, in accordance with the 2019 EPA PFAS Action Plan.

Several bills have been introduced in Congress, and the House approved a number of these bills this summer. These bills are now in conference. The House wants the federal EPA to act more quickly on PFAS.

“It seems likely that at least PFOA and PFOS will be designated as hazardous substances under CERCLA within the next two years (if not sooner). Environmental professionals need to be following these developments closely, as designation as a hazardous substance will bring these substances within the scope of a standard Phase I ESA.”

~Amy Edwards, Attorney and Partner, Holland & Knight

What other types of litigation exposure for PFAS do commercial property owners face?

Edwards: The risk of toxic tort litigation, environmental litigation, enforcement, and increased remediation costs will likely increase as more information about the extent and health impacts of PFAS are gathered. Drinking water is EPA’s primary concern based on identified human health risks for certain PFAS compounds. There is currently no drinking water standard at the federal level, but there is a Health Advisory of 70 ppt for the combined total of PFOS and PFOA.

Per the February 2019 EPA PFAS Action Plan, EPA is moving forward with developing MCLs for PFOA and PFOS. The next step in the SDWA process is to propose a regulatory determination.

It is important for EPs to be aware they can’t only rely on the federal government. States are clearly driving some of the attention by issuing standards or guidance for certain PFAS that could drive remedies for Superfund and other contaminated sites located in those states. Consultants should look carefully at what the state is doing to see how it might impact the focus of a particular environmental due diligence project. To date, 10 states have promulgated PFAS soil screening levels, which indicate further investigation, and potentially remediation, is necessary.

Other federal statutes, such as Toxic Substances Control Act, and the common law, and product liability laws, are likely to drive liability issues and risk management decisions going forward.

What does PFAS mean on M&A due diligence? What are some considerations to be aware of?

Edwards: If you’re involved in environmental due diligence for a corporate client involved in an M&A transaction, assess whether the target company is likely to have manufactured, used or discharged PFAS. If your corporate client is likely to have manufactured or used PFAS, consider conducting company-wide compliance audits to determine potential EH&S liability. The client may want to consider whether to escrow funds for remediation and putting measures in place to minimize PFAS spills and discharges.

What about investigation and remediation costs for PFAS?

Edwards: A confidential source estimates that potential nationwide PFAS environmental cleanup liabilities will be between $40 billion and $60 billion, and that drinking water supply remediation costs are approximately $3,000 to $5,000 per customer served so PFAS are obviously expensive to remediate. Part of the problem is that PFAS are resistant to traditional remedial measures (e.g., chemical oxidation and bioremediation). PFAS plumes are also significantly larger than dry cleaning solvent plumes, and PFAS leaches to soil like chlorinated solvents.

Investigation costs are more expensive because 1) consultants must utilize different clothing and equipment to avoid PFAS cross-contamination, and 2) laboratory analysis costs for PFAS are currently 4x higher than for other compounds. Best practices for remediation of soil and groundwater have not yet been established, although EPA did recently provide guidance on incineration.

Do you expect we’ll see more reopeners at sites with operations associated with high potential PFAS risk?

Edwards: The NY DEC and NJ DEP have both expressed a willingness to reopen closed sites to sample for PFAS, and there’s an expectation other states will follow suit.

What are some steps for mitigating PFAS risk and keeping the deal alive?

Edwards: Superfund liability is retroactive. Thus, inclusion of PFAS in a Phase I is a proactive measure that may assist with Bona Fide Prospective Purchaser liability defense under Superfund if PFAS are listed as hazardous substances in the future. Until then, PFAS should be added as a “non-scope” consideration for Phase I due diligence in real estate and corporate transactions. Clients may also wish to evaluate whether environmental insurance products are available to mitigate any liabilities/risks. The reality is with states acting on PFAS already, and the US EPA and Congress now focused on PFAS risks, the question is, do you want to play Chicken Little and wait for PFAS to be designated or not? The writing is on the wall: the future will be here soon, so it’s important to be proactive.

Leslie Nicholas, Senior Consultant at BBJ Group

What makes PFAS so challenging?

Nicholas: PFAS is often referred to as “ubiquitous” because these compounds are found in so many different products. They also move very quickly so PFAS is being detected at many different types of sites across the U.S. – and they can be challenging to clean up when found in the subsurface. Yet, the regulatory process for identifying, studying, and issuing standards for new contaminants is slow and methodical, often involving time for public comment periods. Public awareness about PFAS is resulting in pressure on state and local regulators to speed up the process. Some states are responding faster than others. Presently, 21 states are proposing or have established standards for individual PFAS. Without a clear regulatory framework, it can be difficult for property owners to develop PFAS management strategies.

Are you addressing PFAS in your Phase I ESAs?

Nicholas: Since PFAS has not been defined by the federal government as a hazardous substance, the likelihood of a release of PFAS is not technically considered a potential recognized environmental condition (REC) under the ASTM E1527-13 Phase I ESA standard. If you think about it, though, it’s fairly unlikely that PFAS impacts would be present in absence of a release of something that is a hazardous substance under the ASTM E 1527-13 standard – so while you may not have a “PFAS REC” per se, you likely already have a REC if you have a PFAS concern.

In this type of situation, while we might not call out PFAS in the Phase I ESA, we would start with apprising the client of the potential risks associated with PFAS along with the other hazardous substances that triggered the identification of a REC in the first place. For example, if the client is going to have a subsurface investigation conducted to investigate the REC, we’d have a conversation about which contaminants are the most appropriate to sample for to evaluate the risk. Even without PFAS as a concern, we’d talk about whether to look for VOCs, SVOCs, metals, etc., and so the conversation simply now includes PFAS as one of the potential contaminant categories to consider. Similarly to how we’d consult with our client about mechanisms they might consider in obtaining purchaser protection when buying a property – we would want to ensure any insurance policies and/or indemnification language includes protections around all potential contaminants associated with the identified REC, which may include one or more PFAS.

How do you talk to your clients about PFAS?

Nicholas: First, we need to make sure they have a good understanding of the risks of PFAS. It’s particularly hard for someone outside of the environmental consulting industry to find usable information given all the media coverage.

“The media is great for increasing public awareness, however, their motivation is typically centered around creating a “buzz” and as such, their use of descriptive words such as “toxic” and “forever chemical” can cloud the real issues around PFAS and real estate. For example, the media tends to treat PFAS as a class of toxic chemicals with common hazards, whereas in actuality the group of PFAS are made up of thousands of chemicals which have some properties in common (such as being highly mobile and difficult to break down), but for which there is no consistent toxicity information or established hazards. We need to make sure our clients understand that knowing which PFAS could be present at their property could can help them determine an appropriate course of action. Once they understand the world of PFAS better, it is a foundation for putting potential PFAS risks into context as compared to potential contamination risks they may have faced in the past with more traditional contaminants.”

~Leslie Nicholas, Senior Consultant, BBJ Group

What about PFAS sampling? How are you helping clients make decisions about when/whether to sample?

Nicholas: Knowing which PFAS may be present is the first step in understanding potential regulatory implications. Of the states with PFAS regulations on the table, they are generally focused around certain compounds (most notably PFOA and PFOS, among a few others). We can thus help our clients determine the likelihood of potential regulatory requirements that may apply to them if evidence suggests that one of the regulated PFAS may be present at their property. We used this as a foundation to discuss the value of performing sampling for PFAS now versus waiting under the regulatory climate is more certain. Proposed future site use (e.g., residential vs industrial) and understanding the hydrogeologic relationship between the property and local drinking water sources play a significant role in such conversations. We then build an action plan that takes these factors into account and best protects our client’s interest in the real estate in question.

For More Information

- Due Diligence at Dawn. If you’re in the Southeast U.S., join us for our DDDs in Charlotte (Nov. 19th) and Orlando (Nov. 20th) to hear more from expert speakers on PFAS risk.

- The Interstate Technology Regulatory Council tracks specific limits for PFAS in this ever-changing regulatory environment.

- In July, we hosted a webinar with more than 1,000 attendees. The complete Q&A document contains answers to commonly-asked questions, organized by broad topic (e.g., Sampling, Sources of PFAS, Regulation, etc).

- Earlier this year, Bloomberg Environment launched a new state action tracker on per- and polyfluoroalkyl substances (PFAS). The tracker provides a continuously updated state-by-state list of policy, legislative, and regulatory developments regarding these substances, including threshold requirements related to the presence of PFAS in water, at contaminated sites, and in specific products. For more information about the Bloomberg Environment content platform, visit https://pro.bloombergenvironment.com/

- To stay current, sign up for SGS’s news updates on PFAS.