Get digitally reproduced photos from each decade, often beginning in the 1930’s and continuing to present day….

Learn moreEDR LIGHTBOX® Data Viewer

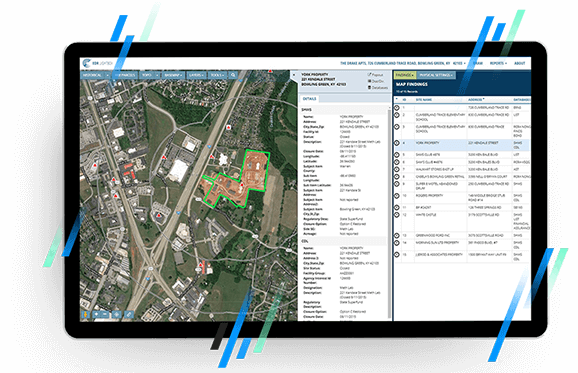

Make your ESA data reviews faster and more accurate

The EDR LIGHTBOX® Data Viewer replaces the need to open and print dozens of PDFs and image files by compiling all the data and historical sources traditionally included in EDR® products in a single browser experience. All EDR® Packages and Radius Map orders include LightBox.

Request A Demo Order Now

Key benefits

Do your best work, faster

Lightbox brings your Phase I data into a single easy to use online viewer. The more data compiled, the more valuable Lightbox becomes, ensuring a comprehensive, high quality review.

Integrated tax parcel boundaries

Enjoy the clarity and precision of tax parcels and property boundaries integrated with historical resources and other critical data layers.

Refine your report findings

Use LightBox FIELDCHECK® to move sites, remove unnecessary findings, and plot unmapped sites.

All the tools you need in one place

Historical overlays, Google Street View, measuring tools, tax parcel data, and more, are all accessible within the application. EDR®’s VEC App is now included with every order, so the tools you need are ready when you need them.

Advanced clarity, faster review, more accurate reports

EDR LIGHTBOX® just keeps getting better.

We’ve added more functionality to our fastest-ever growing product, allowing you to analyze vapor risks, move and adjust map findings, and improve the data powering your future reports.

The most trusted data and content

Analyze your EDR® Radius Map, SANBORN MAP®s, historical aerials, topographic maps, and more in a single browser.

Lightbox utilizes advanced tax-parcel georeferencing for fast, accurate review.

All the tools you need in one place

Historical overlays, Google Street View, measuring tool, tax parcel data and more are all accessible within the application.

EDR®’s VECApp is now included with every order, so the tools you need are ready when you need them.

Greater control over your reports

With the addition of FIELDCHECK®, you can adjust search results in your EDR® Radius Map reports quickly and easily within Lightbox, improving report accuracy.

Connected Data

Building Footprints

Building footprints are geospatial boundaries that provide the outline of a building drawn along the exterior walls.

Flood Risks

Data includes, but is not limited to, 100-year and 500-year flood zones. Canadian Flood maps provide flood extents and depths for multiple return periods, covering river, surface and coastal flooding.

Historical Imagery and Content

Collection of historical content including SANBORN® Maps, Historical Aerial Photography, Historical City Directories, Historical Topographic Maps, Environmental Liens and AULs, and Historical Title.

Have questions? Want a demo? Let’s chat.

Fill out the form below and a member of our Sales Team will contact you shortly.

Recommended Insights

USEPA Issues Expected Rule Designating PFAS as CERCLA Hazardous Substance

The Changing Landscape of Data Center Zoning